The Emergence of

Venture Capital Funds

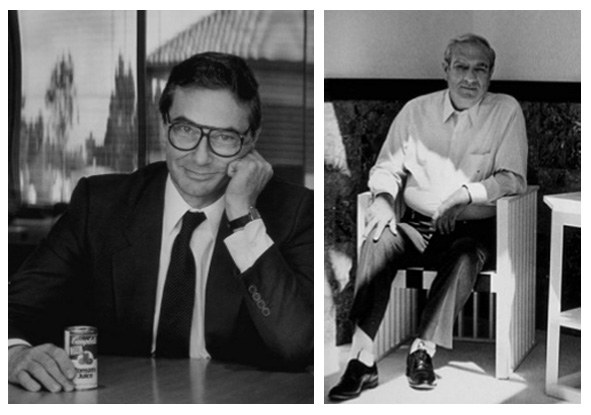

In 1972, Sandy Robertson asked John Anderson to introduce Eugene Kleiner and Tom Perkins to a local industrialist. John heard the pitch and committed to participating in the fund, becoming Kleiner Perkins’s first limited partner.

Tom Perkins (Hewlett-Packard), left, and Eugene Kleiner (Fairchild Semiconductor), raise their first Venture Capital fund in 1972. They consider themselves the first venture capitalists with industry and entrepreneur backgrounds.

Expanding our Venture Capital Initiative

We have significantly expanded our venture capital portfolio by investing with top-tier firms. Today, our portfolio includes fund managers who invest across all stages of the venture capital universe.

Direct Investing Initiative

We complement our top-tier fund managers by actively pursuing direct investments in early-stage tech companies.

Though we see numerous unsolicited opportunities, our preferred approach is to co-invest alongside our existing fund managers and within our family office network.

Current Portfolio Companies

Exited Portfolio Companies

IPO 1991

Acquired by Biogen

2003

IPO 1995

IPO 1997

Acquired by Lightbridge

2000

World Medical

Acquired by Medtronic

1998

Acquired by Cadence Design Sys.

1999

Acquired by

Computer Associated

1999

Diamond Lane Comm.

Acquired by Nokia

1999

onDisplay

IPO 1999

Acquired by Vignette

2000

IPO 1999

Acquired by webMethods

2002

IPO 1999

Acquired by webMD

1999

Eloquent

IPO 2000

Acquired by Open Text

2003

IPO 2000

Acquired by Edmentum

2003

IPO 2005

Acquired by

Charles Schwab

2011

IPO 2006

Acquired by IBM

2015

What is Unique

About Our Story

Anderson Japanese Gardens evolved from John & Linda Anderson’s vision to create a unique backyard amenity to an internationally renown public garden. What started as a backyard project in 1972 is now considered one of the highest quality Japanese gardens in the world.

The presentation ceremony of the American Association of Nurserymen’s National Landscape Awards presented at the White House by Nancy Reagan, May 19, 1988.